Mortgage Tips & Tricks

Resources

Since the world of mortgages is so confusing and difficult, it’s hard not to feel like a passerby while everything happens around you. Various professionals are using vernacular to which you’re not accustomed and you walk away from most conversations with more questions than you had before. If this is the case, we’ve compiled some mortgage tips and tricks in South Carolina.

As well as first-time home buyer tips and tricks, we’ll have advice for keeping rates low and avoiding common mistakes. By following our advice, you can simplify the mortgage process and reduce the risk of poor decision-making.

How to Keep Your Mortgage Rates Low

Always Be Honest – First and foremost, we understand why some people feel the need to hide certain details on their applications. After all, it’s difficult not feeling a little exposed when everything about your life is on paper. However, the best way to ensure a smooth application and gain the trust of all parties is to be honest.

Boost Your Credit Score – Ah, the credit score – this one number causes so much pain and anguish each year. If you want to secure the best mortgage rates this year, improving your credit score is perhaps one of the most powerful things you can do. The higher your credit score, the lower the risk for lenders. When it comes to mortgage loan tips and tricks in South Carolina, it doesn’t get much better than this.

Increase Your Down Payment – Once again, the aim here is to decrease the size of the risk for the lender. If you’re able to put more money down initially, this reduces the required loan amount, and the lender may be willing to offer a better deal.

Reduce Your Debt – During a mortgage application, lenders will consider your debt-to-income ratio, otherwise known as your DTI ratio. If you can reduce all other debt, the impact the mortgage has on your financial position won’t be quite so severe. As a result, lenders will look at your application more favourably.

Common Mistakes to Avoid When Applying for a Mortgage

Sadly, some prospective buyers make simple mistakes when applying for a mortgage and it means that they get stuck with a higher interest rate (or their application gets rejected completely!). Here are some mistakes to avoid:

Not Getting Multiple Quotes – If you only get a quote from one lender, you could be missing out on a much better deal elsewhere. Fortunately, this is where we come in at BrickWood Mortgage, Inc. Regardless of what loan type you require, we will seek the best rates for your position. With so many variables that go into a mortgage offer, make sure you compare the market and get the best offer possible.

The good news is that BrickWood Mortgage, Inc. is signed up with the best national lenders. Above all else, this means that we can do your shopping for you. When you choose us, we’ll place your mortgage with the lender offering the best interest rate for your situation.

At this point, we should note that lenders shouldn’t have to pull your credit for an initial quote. Instead, ask them to base a quote off of your estimated credit score. By doing this, you won’t have lots of unnecessary credit pulls on your profile and you can still compare quotes equally.

Opening New Credit – That’s right – opening new credit is one of the worst things that you can do while applying for a mortgage. Whether a vehicle loan or a personal loan, applying for another source of credit while applying for a mortgage will impact your credit score as well as your DTI ratio. With this in mind, wait for a new car or a new source of credit if you’re in the middle of a mortgage application.

Working with the Wrong People – We might be biassed at BrickWood Mortgage, Inc. but we don’t believe that anybody should feel forced into decisions. Every year, we speak to people who are tired of dealing with pushy loan officers and wish they came to us sooner. Never feel pushed into anything when buying a house – make sure you’re happy before signing on the dotted lines.

Forgetting to Remove Freezes – When applying for a mortgage, lenders will want to review your credit. However, potential lenders won’t be able to pull your credit or check your profile if you have a freeze on it. Therefore, it’s always best to check your account before applying for a mortgage. If you have any freezes on your credit profiles, remove them as soon as possible (you can normally do this by contacting the appropriate credit bureau by phone or online).

With this, you have some more home loan tips and tricks in South Carolina.

Questions to Ask a Lender or Mortgage Company

Whether you’re looking for VA loan tips and tricks in South Carolina or any other type of loan, there are some questions that you should ask if you want to understand your mortgage properly. Below, we’ve listed just some of these for you.

This will determine your monthly payments and the percentage of your payments that go toward the actual loan compared to interest payments.

Depending on the agreement, this can mean a difference between 5%, 10%, or even 15% or 20%. When it comes to an FHA loan, the most common down payment for first-time buyers is 3.5%.

This is an important question because it determines how long you will be paying the mortgage. Will you be paying it for 15 years, 30 years, or longer? Generally, 15 or 30 years are the most common options.

Currently, we offer both adjustable products and fixed products so we have expertise in both areas. When looking for a mortgage, ask this question to be sure about your mortgage before signing. Typically, a fixed rate will last for the duration of the mortgage.

Finally, remember to ask your mortgage company about this process. When buying a property, all rates need to be locked before closing. Every lender has unique rate lock policies, so it’s best to check.

Contact Us Today – If you need help obtaining a mortgage or worry about not getting the best rates for your financial position, contact BrickWood Mortgage, Inc. today!

How to Decide Between Renting and Buying in South Carolina

Deciding whether to rent or buy a home is a big decision, and it’s one that many South Carolinians face. Whether you’re new to the state or simply looking to make a change in your living situation, understanding the pros and cons of both renting and buying is essential. This decision depends on factors such as your financial situation, lifestyle, and long-term goals. In this blog post, we will help you navigate the process of choosing between renting and buying a home in South Carolina.

Renting a Home in South Carolina

Renting has long been a popular choice for many people, especially those who are unsure about settling down or simply need flexibility. Renting means you do not have to worry about property maintenance, paying property taxes, or dealing with large upfront costs. If you are considering renting a home in South Carolina, here are some benefits:

Pros of Renting:

- Flexibility and Mobility: Renting offers flexibility in terms of mobility. If your job requires relocation, or you are uncertain about staying in a particular area for the long term, renting allows you to move when your lease ends. For example, if you’re living in Charleston and find a job opportunity in Greenville, you won’t be tied down by the responsibility of selling a property.

- Lower Initial Costs: Renting typically involves fewer upfront costs compared to buying. While buying a home requires a down payment (usually around 10% to 20% of the home’s purchase price) and closing costs, renting only requires a deposit and possibly the first month’s rent. These lower initial costs can be ideal for people who do not have significant savings or who are just starting out in life.

- Maintenance-Free Living: Renters are not responsible for the upkeep of the property. If something breaks, like a dishwasher or air conditioning unit, your landlord or property manager will handle repairs. This can be a relief for those who do not want to take on the time, effort, and cost of home maintenance.

- No Risk of Property Depreciation: When you rent, the risk of property value fluctuations is not your concern. If the housing market drops, you won’t lose money on your home’s value. For renters, their monthly payments are the only financial obligation, without the risk of losing equity if the market shifts.

Cons of Renting:

- No Equity Building: Rent payments contribute to the landlord’s wealth, not yours. Unlike a mortgage, which can help you build equity over time, rent payments don’t offer long-term financial benefits. In South Carolina’s growing housing market, this can mean missing out on the opportunity to own a home that appreciates in value.

- Rent Increases: Rent prices are often subject to annual increases. Your landlord may decide to raise the rent once your lease expires, which could make it more difficult to budget for long-term expenses. This is particularly true in areas with rising demand, such as Charleston or Columbia, where the cost of living is increasing.

- Limited Control Over Property: As a renter, you don’t have the same freedom to make changes or renovations to the property. You may not be able to paint the walls, remodel the kitchen, or even have pets without the landlord’s permission. This lack of control can make renting feel less like home.

- Less Stability: Renting can offer less long-term stability, especially if your landlord decides to sell the property or not renew your lease. If you’re renting an apartment or house in a competitive market, you may find that securing a new lease at the same rate can be difficult.

Buying a Home in South Carolina

Buying a home in South Carolina can be an exciting and rewarding decision. The state offers a variety of options for homebuyers, from coastal properties to rural retreats and everything in between. However, buying a home also comes with responsibilities, and it’s not a decision to be taken lightly.

When making such an important financial commitment, it’s important to work with reputable mortgage lenders in SC to ensure you get the best financing options available for your needs. A trusted mortgage broker can guide you through the process, helping you secure a loan with favorable terms and interest rates.

Pros of Buying:

- Building Equity: One of the most significant advantages of buying a home is that you build equity over time. Every mortgage payment you make increases your ownership in the property, and over the years, you will own more of your home. This is particularly valuable if you plan on staying in South Carolina for the long term, as home prices in many areas are likely to appreciate.

- Tax Benefits: Homeowners can take advantage of various tax benefits, such as the ability to deduct mortgage interest and property taxes from their federal income taxes. This can result in substantial savings, especially in the early years of your mortgage when interest payments are typically higher.

- Stability and Security: Owning a home provides long-term stability, as you are not subject to rent increases or the risk of being forced to move. You have the freedom to stay in the same location for as long as you choose, whether that’s in a suburban community like Greenville or a beach town like Myrtle Beach.

- Customization and Control: When you own your home, you have complete control over the property. You can make modifications to suit your personal tastes, from landscaping to remodeling your kitchen or even adding a swimming pool. This sense of ownership and freedom is one of the biggest advantages of buying over renting.

Cons of Buying:

- High Initial Costs: Buying a home requires a substantial initial investment, including the down payment, closing costs, and moving expenses. In South Carolina, the average down payment for a home can range from 10% to 20% of the home’s purchase price. Additionally, you will need to pay for inspections, appraisals, and insurance, which can add up quickly.

- Maintenance Responsibilities: Homeownership comes with ongoing maintenance costs. You will be responsible for everything from lawn care to fixing a leaky roof. While this can be an advantage for some who enjoy DIY projects, it can be costly and time-consuming for others. In coastal areas of South Carolina, for example, homeowners may need to contend with issues like hurricane damage or saltwater corrosion.

- Risk of Depreciation: While homeownership can be a good long-term investment, it’s not without its risks. The value of your home can fluctuate based on the market, and if property values decline, you could end up losing money. This is particularly true in areas with volatile housing markets, such as Charleston or the more rural parts of South Carolina.

- Less Flexibility: Once you buy a home, it can be harder to move quickly. Selling a home takes time, and you may be stuck in a location if your job or lifestyle changes. Homeownership offers less flexibility than renting, which could be an issue if you are considering relocating in the near future.

Key Factors to Consider

When deciding whether to rent or buy a home in South Carolina, it’s essential to consider the following factors:

- How Long Do You Plan to Stay? If you’re planning on staying in South Carolina for several years or more, buying may be the better option. On the other hand, if you anticipate needing to move within a few years, renting offers more flexibility.

- Financial Situation: Evaluate your current financial situation. Do you have enough savings for a down payment, or would you prefer to keep your cash flow available for other expenses? Make sure you can comfortably afford the costs associated with buying a home, including mortgage payments, insurance, and maintenance.

- Local Market Conditions: Take the time to research the local real estate market in South Carolina. Housing prices can vary widely depending on location, with higher costs in cities like Charleston and Columbia compared to more rural areas. If you’re unsure about the market or need advice, a local real estate agent can offer helpful insights.

- Lifestyle and Preferences: Think about your lifestyle needs and preferences. Do you value having a backyard or extra space for family activities? Or do you prefer a low-maintenance apartment or townhouse? Consider what kind of environment will make you happiest in the long run.

Deciding between renting and buying a home in South Carolina is a decision that requires careful consideration of your finances, lifestyle, and future plans. Renting offers flexibility and fewer responsibilities, but buying allows you to build equity and gain stability. The key is to evaluate your personal situation and long-term goals before making your decision.

If you’re ready to explore your home financing options, contact BrickWood Mortgage, Inc. today! Our experienced team is here to help you understand your mortgage options and find the best loan for your needs.

Call us at (843) 314-4101 to learn more about how we can help you secure your dream home in South Carolina.

New vs. Old Homes in North Myrtle Beach: Pros & Cons

North Myrtle Beach, a picturesque city on the Grand Strand in South Carolina, offers a blend of coastal charm, recreational opportunities, and thriving real estate options. If you’re considering purchasing a home in this vibrant area, you might be weighing the choice between a new home and an older one. Each option comes with distinct advantages and challenges. Let’s explore the pros and cons of new versus old homes in North Myrtle Beach to help you make an informed decision.

Pros of Buying a New Home in North Myrtle Beach

- Modern Features and Amenities:

New homes often come equipped with the latest in design, technology, and energy efficiency. Open floor plans, smart home systems, and high-quality appliances are common. These modern features provide convenience and appeal to those who value contemporary living.

- Energy Efficiency:

New homes are built to meet current energy standards, including better insulation, energy-efficient windows, and advanced heating and cooling systems. These features can result in lower utility bills and a reduced carbon footprint.

- Low Maintenance:

With everything being brand new, from the roof to the plumbing, new homes typically require minimal maintenance in the first few years. This can save you money and effort compared to the repairs and updates often needed in older homes.

- Customization Options:

Purchasing a new construction home often allows you to personalize certain aspects, such as choosing finishes, paint colors, or even room layouts. This level of customization ensures that your home aligns with your taste and lifestyle.

- Warranty Coverage:

Many new homes come with builder warranties that cover structural issues, systems, and appliances for a specific period. This provides peace of mind and financial protection against unexpected issues.

If you’re planning to buy a new home and looking for mortgage options, call our North Myrtle Beach mortgage brokers at (843) 314-4101 for a smooth and hassle-free experience.

Cons of Buying a New Home in North Myrtle Beach

- Higher Purchase Price:

New homes typically cost more upfront compared to older homes of similar size in the same area. The added cost can be a barrier for some buyers.

- Limited Landscaping and Neighborhood Maturity:

Newly built homes often lack mature landscaping. It can take years for trees and plants to grow and for the neighborhood to develop a sense of community and character.

- Potential Construction Noise:

If the home is in a developing community, ongoing construction can be noisy and disruptive until the area is fully completed.

- Smaller Lots:

Newer homes are sometimes built on smaller lots compared to older properties. If outdoor space is important to you, this might be a drawback.

- Less Unique Character:

New homes often have a uniform appearance, especially in large developments. This may lack the charm and individuality found in older properties.

Pros of Buying an Older Home in North Myrtle Beach

- Established Neighborhoods:

Older homes are often located in well-established neighborhoods with mature landscaping, larger trees, and a sense of community. These areas can provide a more lived-in and inviting atmosphere.

- Unique Architectural Details:

Older homes frequently showcase craftsmanship and design elements that are hard to find in newer constructions. Features like hardwood floors, intricate moldings, and spacious layouts add character and charm.

- Potential for Lower Costs:

Older homes may come at a lower purchase price than new homes, especially if they require updates or renovations. This can make them more accessible to budget-conscious buyers.

- Larger Lots:

Many older homes are built on more generous plots of land, offering additional outdoor space for gardening, entertaining, or relaxing.

- Location Advantage:

Older homes are often situated closer to the heart of the city, near popular attractions like Main Street, McLean Park, and the beach. This proximity can be a significant convenience and add to the property’s value.

` in North Myrtle Beach

- Higher Maintenance Costs:

With age comes wear and tear. Older homes may require repairs or updates, such as replacing the roof, upgrading electrical systems, or fixing plumbing issues. These costs can add up quickly.

- Energy Inefficiency:

Older homes may not meet modern energy efficiency standards. Inefficient windows, outdated HVAC systems, and poor insulation can result in higher utility bills.

- Limited Modern Features:

Older homes may lack the open floor plans and technological upgrades that many buyers desire. Remodeling might be necessary to meet modern preferences.

- Asbestos and Lead Concerns

Homes built before the 1980s may contain hazardous materials like asbestos or lead paint. Addressing these issues can be costly and time-consuming.

- Outdated Layouts

Older homes may have layouts that do not align with today’s lifestyles, such as smaller kitchens, fewer bathrooms, or closed-off rooms. Remodeling might be needed to create a more functional space.

Making the Right Choice

Choosing between a new and an old home in North Myrtle Beach ultimately depends on your priorities, budget, and lifestyle. Consider the following factors to guide your decision:

- Budget: Determine how much you can afford, including the potential costs of renovations or maintenance for an older home.

- Location: Decide whether you prioritize being close to the beach, Main Street, or other attractions.

- Features: List the features most important to you, such as energy efficiency, unique architecture, or outdoor space.

- Maintenance: Evaluate how much time and money you’re willing to invest in upkeep.

Why North Myrtle Beach Real Estate is a Smart Investment

The real estate market in North Myrtle Beach offers a mix of affordability, scenic beauty, and investment potential. The city’s geographical location on the eastern coast, combined with its vibrant tourism-driven economy, makes it an attractive destination for homebuyers. Additionally, the area’s lower property taxes and diverse housing options create opportunities for both primary residences and vacation homes.

Whether you’re drawn to the charm of an older home or the modern amenities of a new one, North Myrtle Beach has something for everyone.

Let BrickWood Mortgage, Inc. Help You Find Your Dream Home

No matter what type of home you choose, financing is a critical step. At BrickWood Mortgage, Inc., we’re here to simplify the mortgage process for you. Call us today at (843) 314-4101 to explore your options and make your dream of owning a home in North Myrtle Beach a reality.

How Can You Reduce Your Total Loan Cost?

Buying a home is likely one of the biggest financial decisions you’ll make in your lifetime. Securing a mortgage loan is a significant part of that journey. But with the excitement of purchasing a new home, it’s easy to overlook the total cost of your loan over its lifetime. The good news is that there are strategies you can employ to reduce the total loan cost, saving you money and potentially shortening the term of your loan.

Understanding Mortgage Loan Costs

Before exploring reduction strategies, it’s crucial to understand what drives the cost of your mortgage loan. Two key components are the principal, which is the amount borrowed, and the interest, which is the fee the lender charges for borrowing the money. Over time, interest can substantially increase the total repayment amount.

Strategies to Reduce Your Total Loan Cost

Here are some effective strategies to help you reduce the total cost of your mortgage loan.

Increase Your Down Payment

The more money you put down, the less you have to borrow, which can save you a considerable amount in interest payments over time. A larger down payment also often results in a lower interest rate because it reduces the lender’s risk.

Opt for a Shorter Loan Term

Choosing a shorter loan term, such as 15 years instead of 30, can save you tens of thousands of dollars in interest. Although your monthly payments will be higher, the interest rate can be lower, and you’ll pay off the loan faster.

Make Extra Payments on Your Principal

If you have extra funds, consider making additional payments towards the principal balance of your loan. This directly reduces the amount owed and can significantly decrease the total interest paid over the life of the loan. Even one extra payment a year can make a noticeable difference.

Refinance Your Mortgage

When interest rates drop, refinancing to a new loan with a lower rate can reduce your monthly payments and your total interest cost. However, be mindful of refinancing fees, which can add up. Calculate whether the savings from a lower interest rate will outweigh the costs of refinancing.

Pay Bi-Weekly Instead of Monthly

Paying half your mortgage payment every two weeks, instead of the full amount once a month, results in one extra full payment each year. This can shave months off your loan term and save you a significant amount in interest.

Maintain a Good Credit Score

A higher credit score can qualify you for lower interest rates. Keep your credit score in check by paying bills on time, reducing your debt-to-income ratio, and checking your credit report regularly for errors.

Utilize Mortgage Points

Mortgage points, also known as discount points, are fees paid directly to the lender at closing in exchange for a reduced interest rate. This can be a good strategy if you plan on staying in your home for a long time, as the upfront cost can be offset by long-term interest savings.

Considerations When Reducing Loan Costs

Reducing your total loan cost isn’t just about paying less interest. It’s also important to consider your overall financial situation.

Personal Budget

Always assess your personal budget and financial goals before making extra payments or refinancing. Ensure that you have enough savings for emergencies and are not neglecting other important financial priorities like retirement savings.

Loan Prepayment Penalties

Some loans come with prepayment penalties, which can negate the benefits of paying off your loan early. Check with BrickWood Mortgage, Inc. Company or your lender to understand the terms of your mortgage.

The Role of Home Equity

Building equity in your home can be beneficial for future financial flexibility. It allows you to potentially borrow against the equity or profit from it when selling your home. Reducing your loan cost effectively builds equity faster.

Tools and Resources for Mortgage Management

To help manage and plan your mortgage loan costs, there are various tools and resources available, such as:

Mortgage Calculators

Online calculators can help you determine the impact of extra payments or refinancing on your total loan cost.

Financial Advisors

A financial advisor can provide personalized advice on mortgage strategies that align with your broader financial plan.

Mortgage Management Software

Some software can track your payments, help you plan for extra payments, and monitor how these payments affect your loan’s term and cost.

Proactive Strategies to Reduce Mortgage Loan Costs

Reducing your total loan cost requires a proactive approach and a clear understanding of your financial situation. Strategies like making extra payments, refinancing, or opting for a shorter loan term can make a significant impact on the amount of interest you pay over the life of your mortgage. By working with BrickWood Mortgage, Inc. and utilizing available tools and resources, you can make informed decisions that lead to substantial savings. Remember, even small changes in your payment strategy can lead to big results over time.

Taking these steps not only helps you save money but also brings you closer to the ultimate goal of owning your home outright. With careful planning and smart financial decisions, you can ensure that your mortgage loan supports your financial well-being for years to come.

Ready to explore your mortgage options? Call BrickWood Mortgage, Inc. today at (843) 314-4101 for personalized guidance. Let us help you find the great path to homeownership with smart financial solutions!

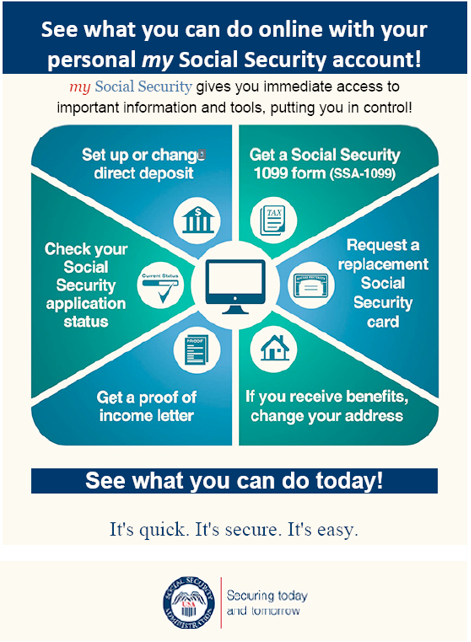

No Social Security?

If you don’t have a Social Security Account, you may want to look into this.

With your free, personal my Social Security account, you can receive personalized estimates of future benefits based on your real earnings, see your latest Statement, and review your earnings history. It even makes it easy to request a replacement Social Security Card or check the status of an application, from anywhere!

What Our Customers Are Saying

Devon Ussher

As a first time home buyer, I was nervous about the process. Tim made this so easy to understand and helped every step of the

Jack McManus

Had a great experience with Brickwood Mortgage. The ongoing communication and follow up was spot on. Paul has a great way of explaining everything and

Katie Bailey

Paul was great to work with. As first time home buyers, we didn’t really know all the details of the process. Paul was very informative

Latest Blog

Stay Informed with Our Latest Posts and Articles

How to Refinance Your Jumbo Mortgage in South Carolina

If you’re a South Carolina homeowner with a high-value property,...

Read MoreHow Much Down Payment is Required for FHA Loans in South Carolina?

When it comes to buying a home in South Carolina,...

Read MoreHow to Use a VA Loan to Buy a Home in South Carolina

For military service members, veterans, and their families in South...

Read MoreCan You Get an FHA Loan on a Mobile Home?

For many South Carolina residents, mobile homes represent an affordable...

Read More